The longer PAP is allowed to remain opaque on state finance, the worse it will be for our children’s future. When the so called finance experts simply trust PAP’s words instead of asking probing questions, we may be slowly digging our own grave.

In every democratic country, the concealment of information which should be in the public domain is unacceptable. Governments attempt to conceal such information only when something is terribly amiss.

Temasek and GIC can’t simply continue to pluck some figures from the air and expect Singaporeans to blindly accept such wild return claims because information isn’t fully controlled by PAP anymore.

Hundreds of billions invested in foreign assets, money belonging to the people but the people have no right to know? PAP has got to be kidding.

It’s such a ridiculous situation and it makes elected MPs look stupid for maintaining their silence. Legislations which have been enacted by PAP to prevent disclosure are not cast in stone.

Top management in our SWFs are not industry professionals but former civil servants. These guys, and a gal, know nuts about investment and are easily taken in by foreigners’ sales pitch. It’s akin to Singaporeans losing millions in Lehman minibonds sold by DBS bank about a decade ago. More recently, the same bank sold more junk bonds issued by Swiber to local investors who are now nursing bigger losses.

The problem with our SWFs is they have an endless stream of funds from land sales, sale of national assets, surplus tax and CPF dollars. They are able to upsize their portfolio every year not because of their superior performance but at the stroke of a pen: through legislation.

Unlike real fund managers, civil servants need not put in any effort to raise funds. Funds have continued to be injected into our SWFs all too easily and likely lead to reckless investing.

Since holding on to cash and waiting for the opportune moment to invest is not an option, tens of billions have been invested in assets at inflated prices.

GIC itself has already acknowledged asset prices were already inflated a few years ago but it still went ahead and invested about $100 billion during the past 3 years.

If “easy come, easy go” is a not a reality, rich kids wouldn’t be splurging their parents’ money, eg $2000 during a lunch-time shopping spree or wearing $10,000 outfits to private schools.

But the funds managed by GIC and Temasek do not belong to PAP elites’ parents; they belong to every Singaporean.

Is there a very big investment ‘lobang’ which PAP has been desperately trying to cover? Temasek’s Ho Ching, wife of the PM, did lose billions before, and even more after, becoming CEO. Why is she still CEO after 12 years? Got succession planning or not?

Singaporeans should not be afraid to demand transparency from PAP because losing our reserves and CPF savings has a direct impact on our well being. And it’s not only a delay in CPF withdrawal; social, healthcare and infrastructure spending have also been reduced.

And each feedback to increase necessary social spending will be met with threats of increasing taxes. 😦

No elected MP seems to have any common sense to ask obvious questions about Temasek and GIC and have left them to unelected opposition members like Chee and Kenneth.

We can see that something is clearly not right by comparing Temasek with arguably the most transparent SWF, Norway’s GPFG.

Norway’s SWF has invested in about 9000 companies and it discloses all of them in its annual report.

So, what’s the issue with disclosing only hundreds of investments held by Temasek and GIC?

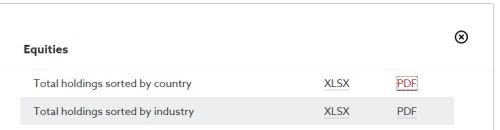

NBIM discloses ALL its equities link (click “REPORTS”)

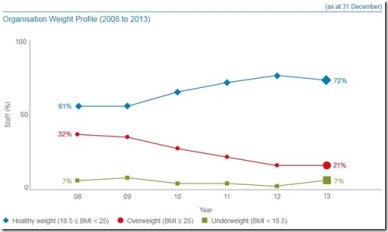

Instead of disclosing material information, Temasek discloses information which is totally useless to stakeholders such as …. its organisation weight profile.

How does the chart below help stakeholders to understand what’s going on with our investments?

Link to an earlier post

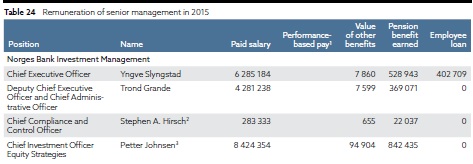

With a portfolio valued at about S$1.25 TRILLION, the CEO is paid only about S$1.05 million and this is again disclosed in the annual report. (exchange rate X 0.17)

Why is Ho Ching’s pay package off limits to the public despite Temasek’s portfolio being only about 20% of GPFG? Is she not earning tens of millions in tax dollars managing our reserves? Know how to feel pai seh meh?

If Temasek is bad, GIC is even worse. Unless of course we can accept the nonsensical justifications cooked up by PAP to conceal all that it doesn’t want Singaporeans to know.

Why are elected MPs afraid to ask obvious questions, afraid to see what’s the true state of our finance? When fully disclosed, will investors flee? Will our Singapore dollar be on par with the ringgit?

Singapore is already doomed by the 70% idiots who prefer to remain blind.

KJ posted this on August 21, 2015, more than a year ago. It is worth a re-read!

Show Us The Money or the Funny World of PAP Accounting