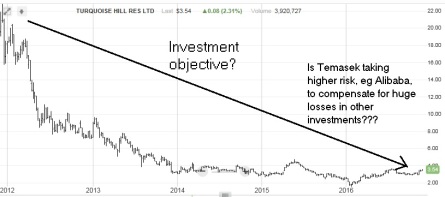

Contrary to government propaganda, Temasek is actually taking high risk with our reserves. A look at its holdings and transactions in Alibaba, with reference to other companies in its US listed portfolio, confirms this.

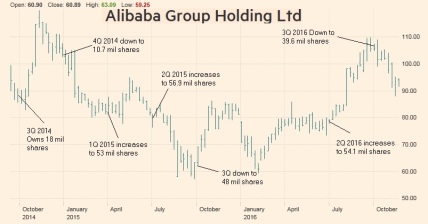

It was recently reported that as at end September, Temasek held a balance of 39.6 million Alibaba ADRs after having disposed some 14.5 million ADRs. link During the previous quarter, Temasek added 6.5 million ADRs. Transactions in Alibaba alone seem to dictate the profitability of its entire US listed portfolio.

Transactions in Alibaba since 2014

Hundreds of million$ could be made or lost in a single transaction involving Alibaba but this is considered “portfolio rebalancing from time to time”? link

Portfolio rebalancing = A single transaction with hundreds of million$ in profit/loss

There is obviously an element of speculation in investing but what is clearly wrong with Temasek’s model is that it has put too many eggs in Alibaba’s basket. Recall that Temasek had also put too many eggs in Barclays and Merrill Lynch and lost a total of more than US$5 billion during the GFC. link

To put Alibaba investment into perspective, Temasek held 31 US listed stocks valued at $12.442 billion as at end September. link At US$3.68 billion, Alibaba accounted for 30% of Temasek’s portfolio.

But what is shocking – Alibaba’s value is higher than the 27 cheapest stocks combined. To top that, Alibaba is an extremely volatile stock. So long as Temasek punts and makes money on Alibaba, it really doesn’t matter if the rest of its ‘investments’ don’t perform.

And there are many investments which have been submerged for a long time. Is Temasek’s exit plan for them “wait till kingdom come”? Examples:

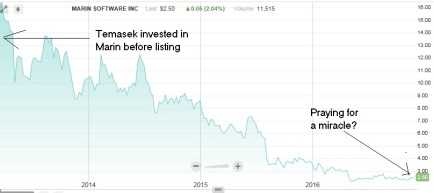

Marin Software Inc

link

link

Virtu Financial Inc

Temasek is also the biggest shareholder in Virtu and a major shareholder in other companies.

Turquoise Hill Resources Ltd

The issue with Temasek’s investment model is that it cannot cut losses as the biggest shareholder. It’s an uncalled for make or break situation, usually the latter.

Many investments appear to be hopeless as the US stock market index has been making new highs throughout 2016. How did Temasek manage to pick so many losers?

Temasek needs to be checked by Parliament by disclosing every investment. Our reserves belong to every citizen, not Temasek or PAP.

As Temasek continues with its reckless management of our reserves, it appears to have not learnt any lesson from gargantuan losses incurred during the GFC.

Very angry. All our MPs must be sleeping in Parliament. Who voted for this mess? The 70% idiots please wake up.

At the rate that GST, ERP, Workers levies, COE, Property Tax, Income Tax, VEP, Land sales are being collected at its will, our total Reserves has probably exceeded $500 billions, $800 billions or even more which not many know? What about our $300 billion hard earned CPF being comingled and retained in GIC?

If the above is indeed the scenario, you would expect GIC & Temasek be spoilt with too much free monies at their disposal. With monies that is bigger than the whole internal economy, it looks like Temasek has no choice but to look outside Singapore to invest. It has come a point that there isn’t too many good buys available and at many times they will be taken for a ride. This is why we have been hearing things like they have picked up up losses like no tomorrow.

With little or no accountability and transparency, no one know exactly how well or how bad they have been performing year in year out? They always tweak the way of reporting to confuse the ordinary. But as a rule of thumb, Singapore never fail to blow its own trumpet if they had performed well such as No. 1 Airport, No. 1 highest ministers pay in the world and etc. So likely they have been under performing so far in the last 10 years, I supposed? But how bad?

However, If they persistently put in poor performance, technically, they can blow away most or all our CPF savings or even our Reserves one day without us knowing. The fact that our CPF contributes almost net $20 billions into the GIC pool every year in the last 5 years or more is their trump card as they would never be a cash/margin call never mind if they continue to lose monies.

With “so much” Reserves in hand, it only help to contribute less than $15 billions to co-fund our budget annually in the last few years, it goes to tell that their performance and return has nothing to shout about. It may well be a case of cover up here and there, who knows?

Singaporeans should ask themselves one very basic question, Singapore has become so wealthy over the last 30 years, what has ordinary Singaporean benefited from the wealth as one continue to pay higher healthcare, housing, food and ever rising living cost?

Who are the one really benefited? The rich become richer and then super rich? No?